Welcome back, crypto enthusiasts! Today, we’re diving deep into the world of Pionex grid bots and how they can help you maximize your returns. With the ever-changing landscape of cryptocurrency trading, understanding the tools at your disposal is crucial for success. Let’s explore how Pionex’s grid bots work, their performance metrics, and why they might be the right choice for your trading strategy.

What are Pionex Grid Bots?

Pionex grid bots are automated trading tools designed to execute buy and sell orders at predetermined intervals, creating a “grid” of trades. This strategy capitalizes on market volatility, allowing traders to benefit from price fluctuations without the need for constant monitoring.

I’ve explored various grid bot platforms, but Pionex stood out due to its user-friendly interface and a wide range of bots available. After testing numerous bots over the past couple of years, I’ve gathered significant insights into their performance.

Performance Overview

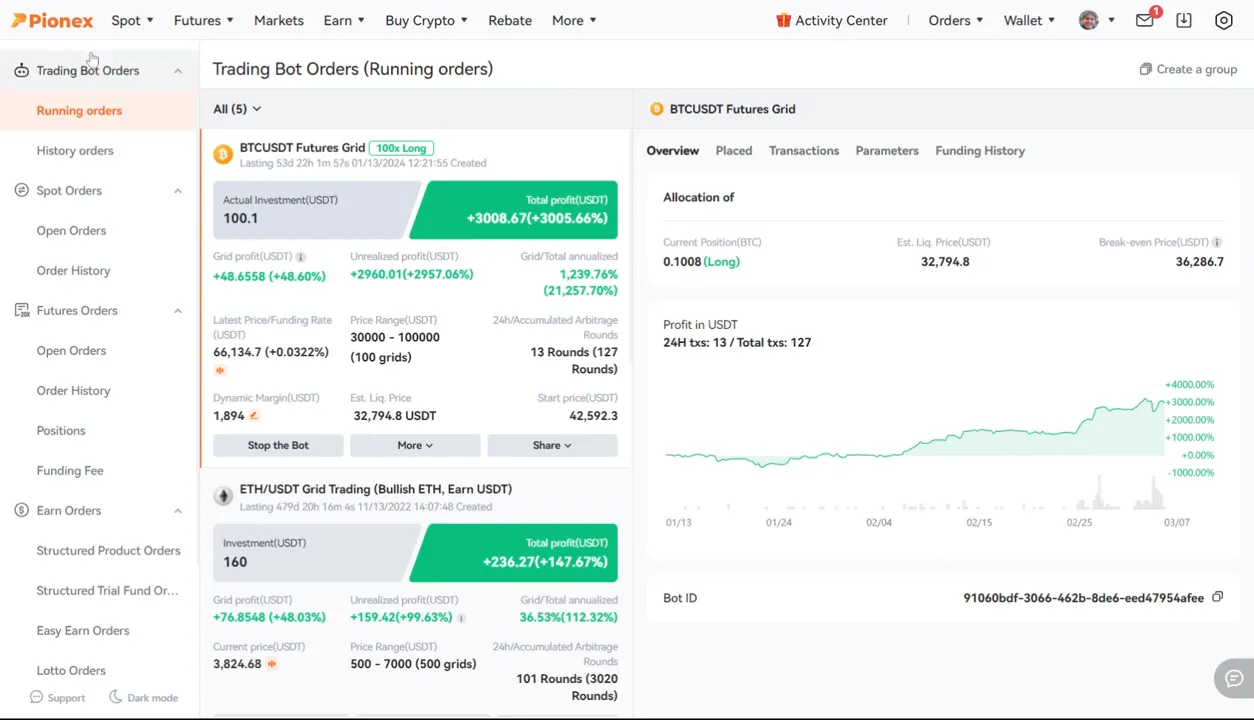

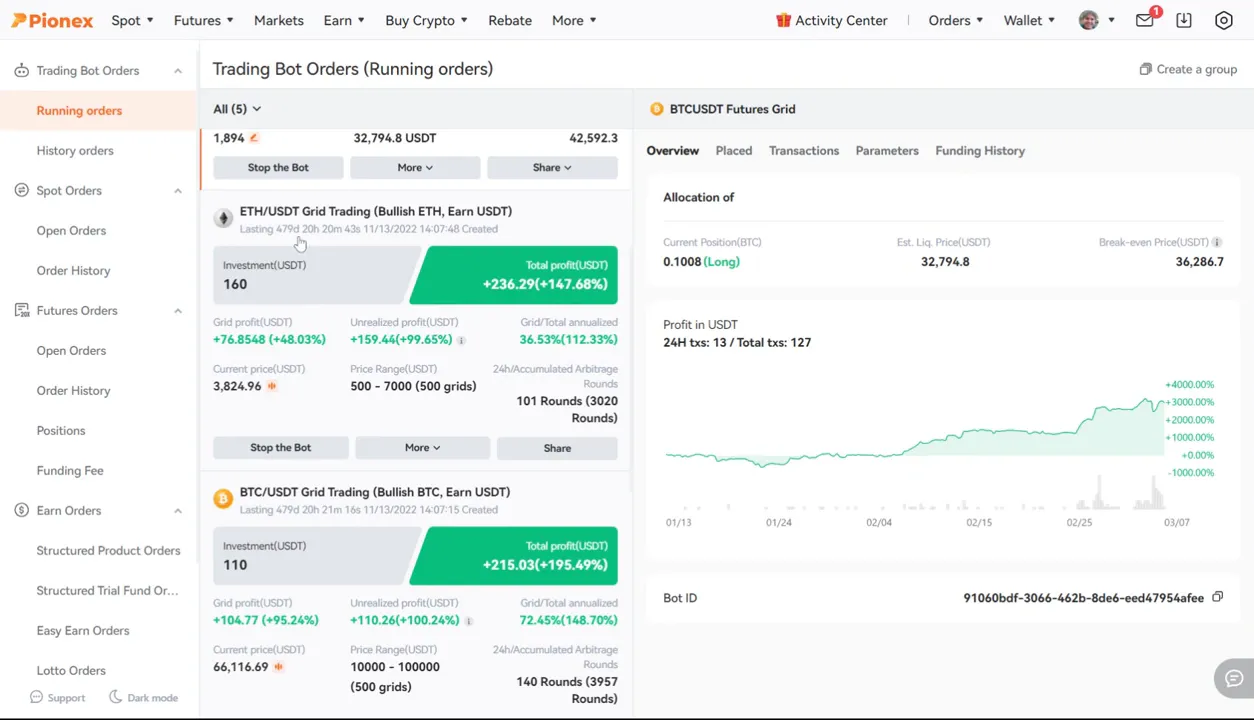

In my experience, I started with a modest investment of $100 and ran about 15-16 different bots over the last 12-18 months. The results have been eye-opening, especially with Bitcoin’s recent bullish run, which peaked near $69,300.

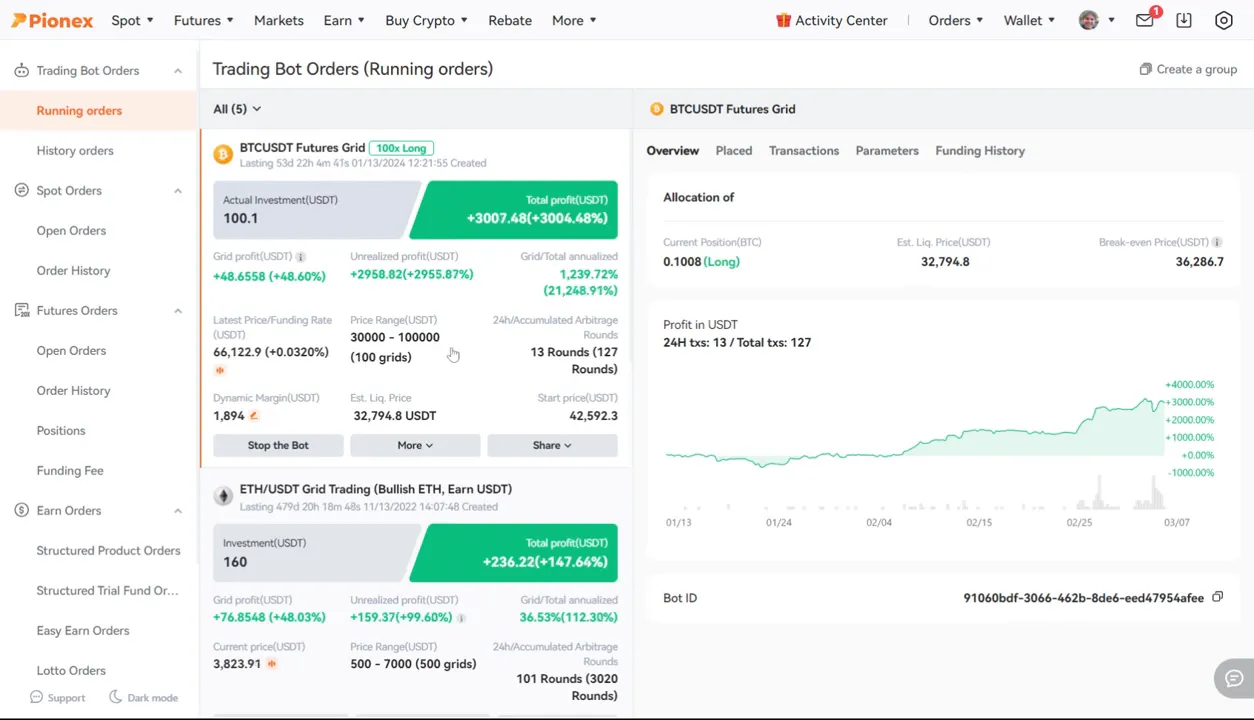

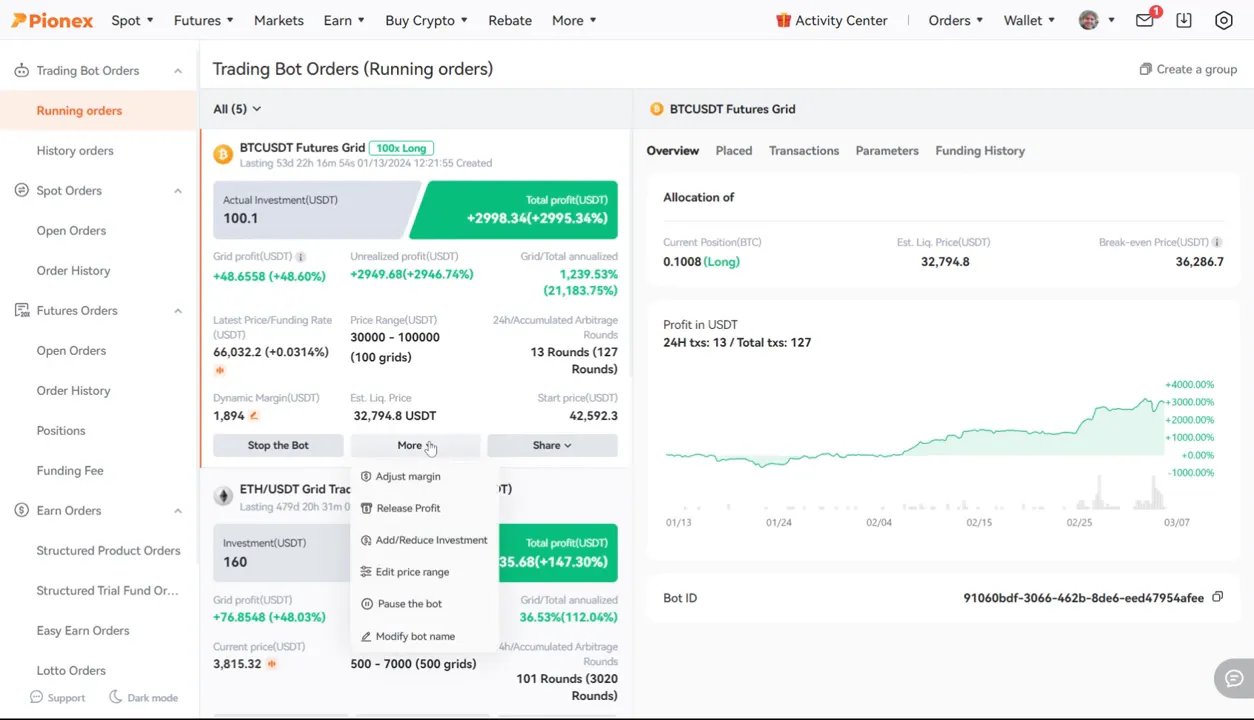

One of the standout performances came from a futures grid bot where I leveraged my position 100 times. Over just 53 days, I saw a staggering 3,000% return on my investment. This isn’t typical, but it highlights the potential of leveraging grid bots effectively.

Understanding Leverage in Grid Trading

Leverage can significantly amplify your returns, but it also comes with increased risk. Pionex allows up to 100 times leverage, meaning a small price movement can lead to substantial gains or losses. While I find this exciting, it’s crucial to approach it with caution. The thrill of trading on minute candles can easily turn into a gamble if you’re not careful.

In my testing, I’ve experimented with different leverage levels, ranging from 0.1% to 10% grid distances. My findings suggest that a 1% grid distance yields the best results for most scenarios.

Personal Experiences with Different Bots

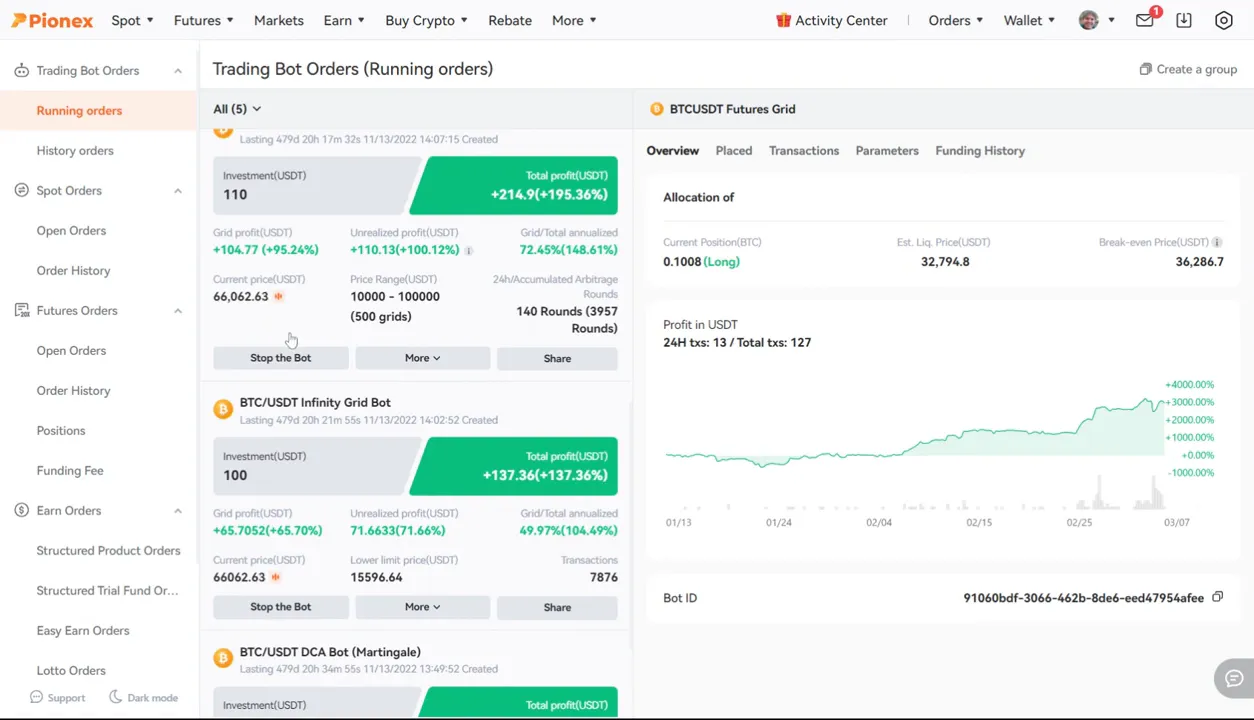

Through trial and error, I’ve tried various bots, including those focused on Ethereum and BTC trading. For instance, my Ethereum-USDT bot has been running for 479 days with a return of 147%. While not spectacular, it still outperforms traditional investment avenues like stocks.

Additionally, I’ve encountered bots with no upper limit on trading range that produced returns around 137%. However, some bots underperformed, especially those that relied on dollar-cost averaging strategies.

Key Takeaways from My Trading Journey

- Start Small: Begin with a small investment to understand how grid trading works.

- Monitor Performance: Regularly check your bots’ performance and adjust parameters as needed.

- Leverage Wisely: While leverage can boost profits, it also increases risk. Use it judiciously.

- Experiment: Don’t hesitate to try different bots and strategies to see what works best for you.

Future Trading Strategies

Looking ahead, my strategy will involve using a leveraged futures grid for currencies I believe are undervalued. A 5% grid distance may be beneficial if I expect significant upward movement. However, I will remain cautious, as these high-leverage positions can turn against you quickly.

For those considering Pionex grid bots, I encourage you to explore their features. You can start trading with Pionex and see how their automated bots can fit into your strategy. Check out Pionex | Bitcoin Ethereum Auto buy low and sell high | Free Crypto Trading Bot for more information.

Conclusion

Check out Pionex grid bots click here have proven to be an effective tool for navigating the complexities of the cryptocurrency market. With the potential for high returns, they offer a unique opportunity for both novice and experienced traders. As I continue to learn and adapt my strategies, I hope to share more insights and experiences with you all.

Feel free to leave comments or feedback, and let’s keep the conversation going about our trading journeys! For more resources on maximizing your earnings with Pionex, check out this guide.