Discover how the Pionex trading bot can help you automate your cryptocurrency investments and create your own crypto ETF. This guide will walk you through the process of using the Pionex trading bot to maximize profits through coin rebalancing strategies.

Introduction to Pionex Trading Bot

The pionex trading bot is a powerful tool designed to automate your cryptocurrency trading strategies. By leveraging advanced algorithms, it enables users to execute trades efficiently, ensuring optimal entry and exit points. The bot operates on a user-friendly platform, making it accessible for both beginners and experienced traders.

With the pionex bot, you can take advantage of various trading strategies, including grid trading and arbitrage, to maximize your profits. This versatility allows for a diversified approach to trading, accommodating different market conditions and personal trading styles.

Why Choose Pionex Trading Bots?

Pionex offers several compelling reasons to consider its trading bots:

- Low Fees: Pionex boasts some of the lowest trading fees in the industry at just 0.05%. This is particularly beneficial for frequent traders who want to minimize costs.

- Variety of Bots: The platform provides multiple trading bots, such as the pionex grid bot and pionex arbitrage bot, allowing users to choose the best strategy for their investment goals.

- Ease of Use: Setting up a trading bot on Pionex is straightforward. Users can quickly configure their bot settings without needing extensive technical knowledge.

- Copy Trading: Pionex allows users to copy the trading strategies of successful traders, making it easier for novices to engage in the market.

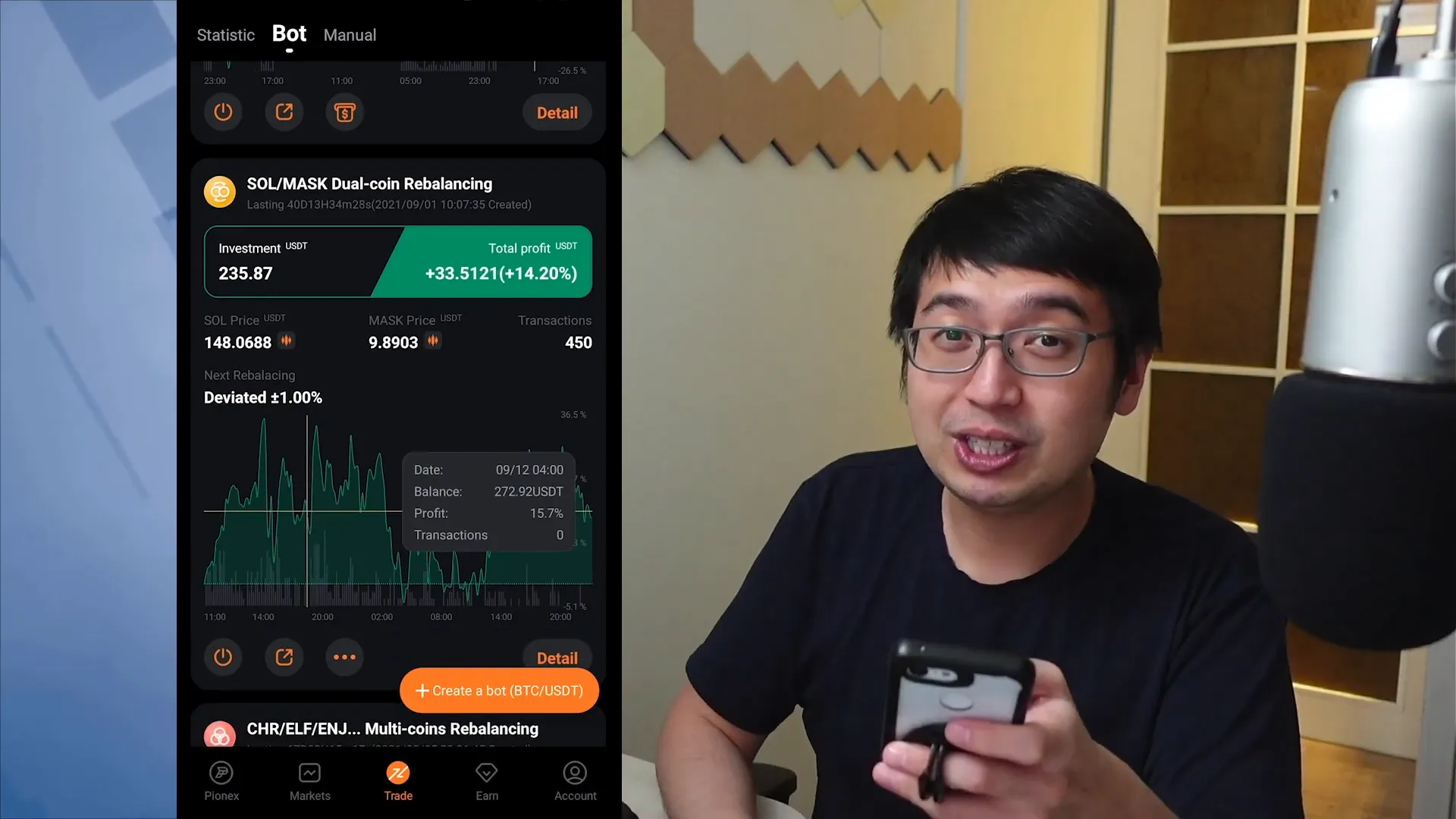

Understanding Coin Rebalancing

Coin rebalancing is a crucial strategy for maintaining a well-diversified portfolio. By regularly adjusting the proportions of different cryptocurrencies in your holdings, you can mitigate risk and capitalize on market fluctuations. The pionex crypto trading bot automates this process, ensuring your portfolio remains aligned with your investment goals.

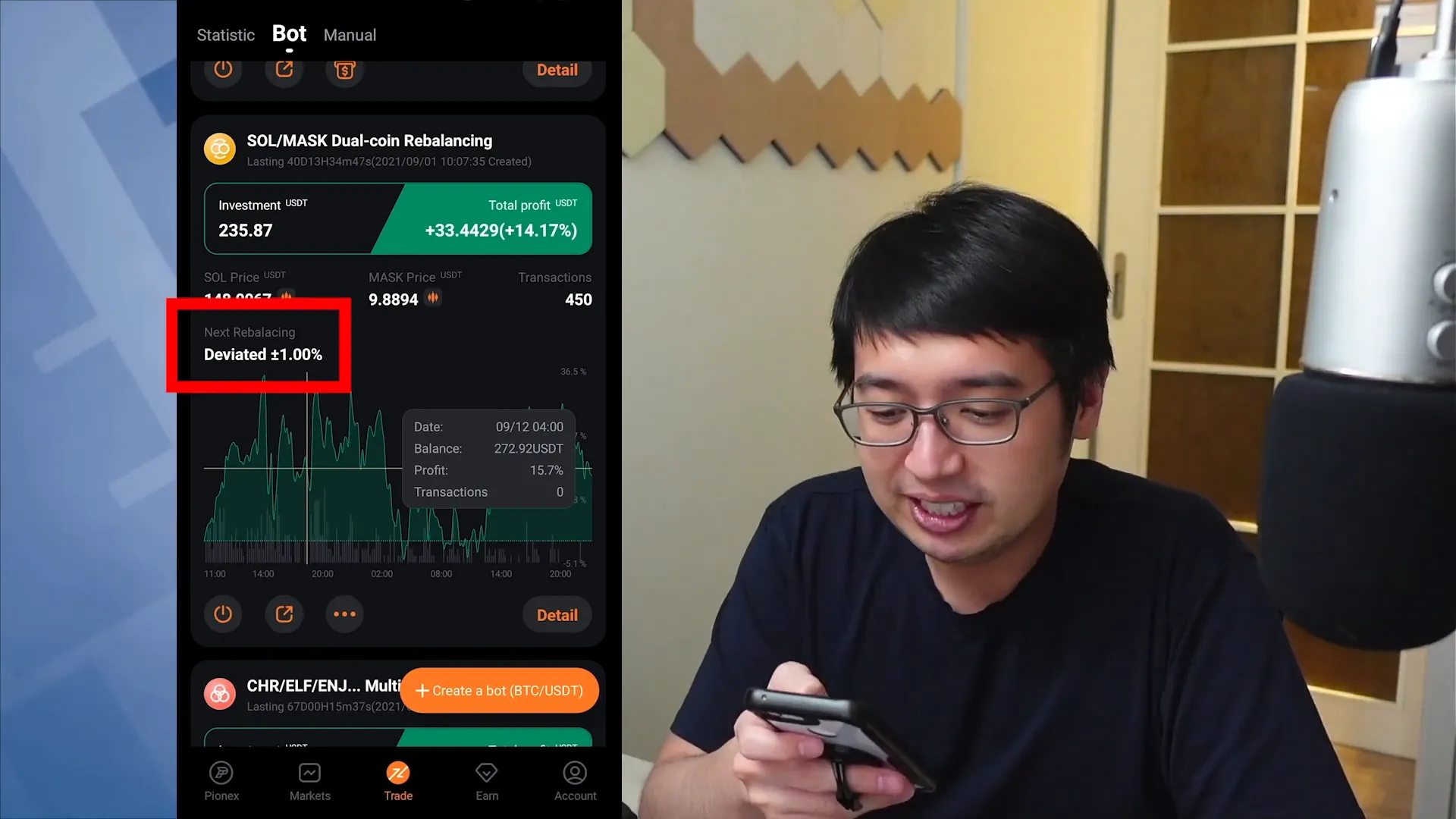

With the Pionex bot, you can set specific parameters for rebalancing. For example, you can choose to rebalance your portfolio when a certain asset’s value deviates from a predetermined threshold. This automated approach takes the emotional decision-making out of trading, allowing for more consistent performance.

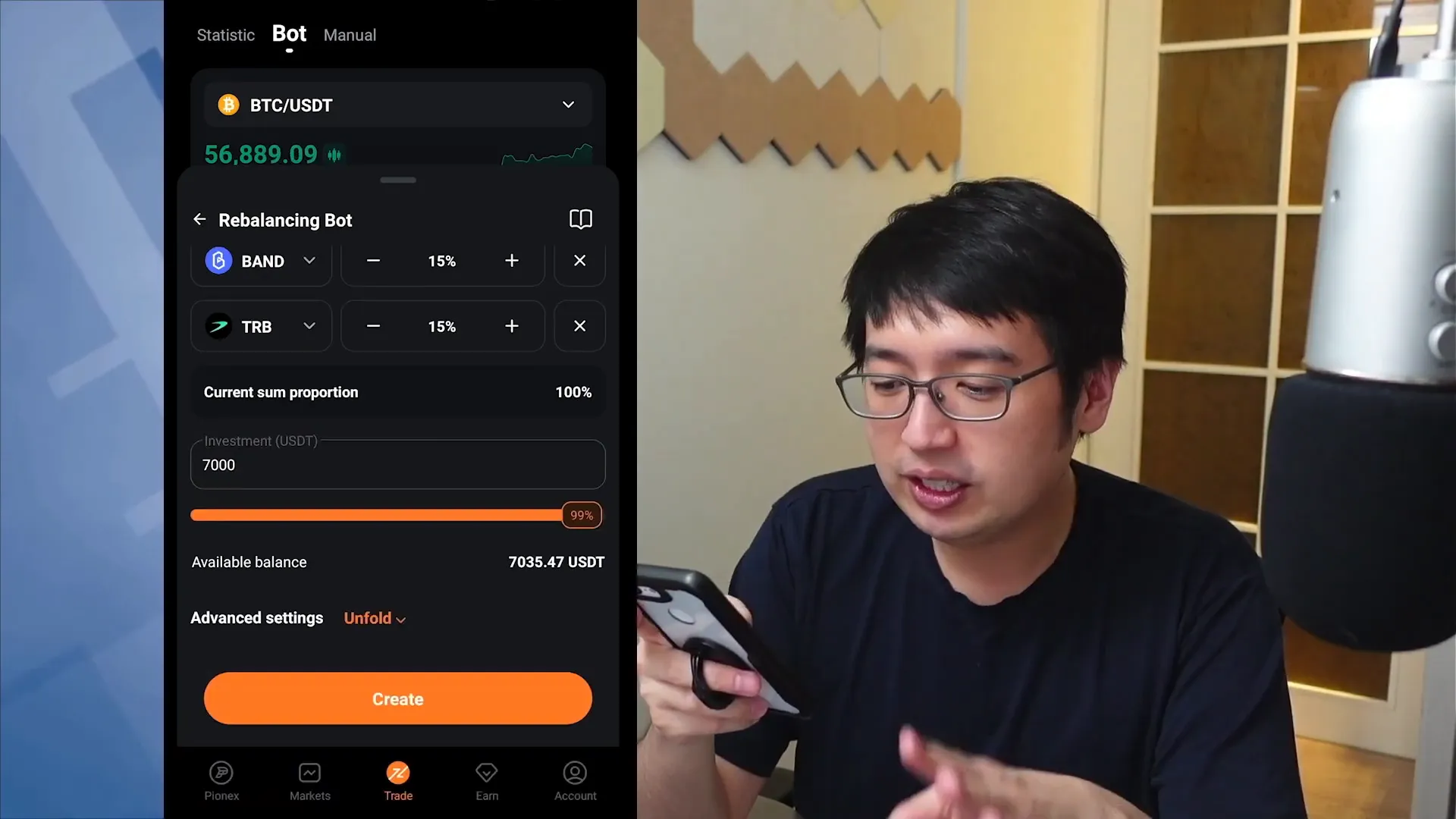

Setting Up Your Crypto ETF

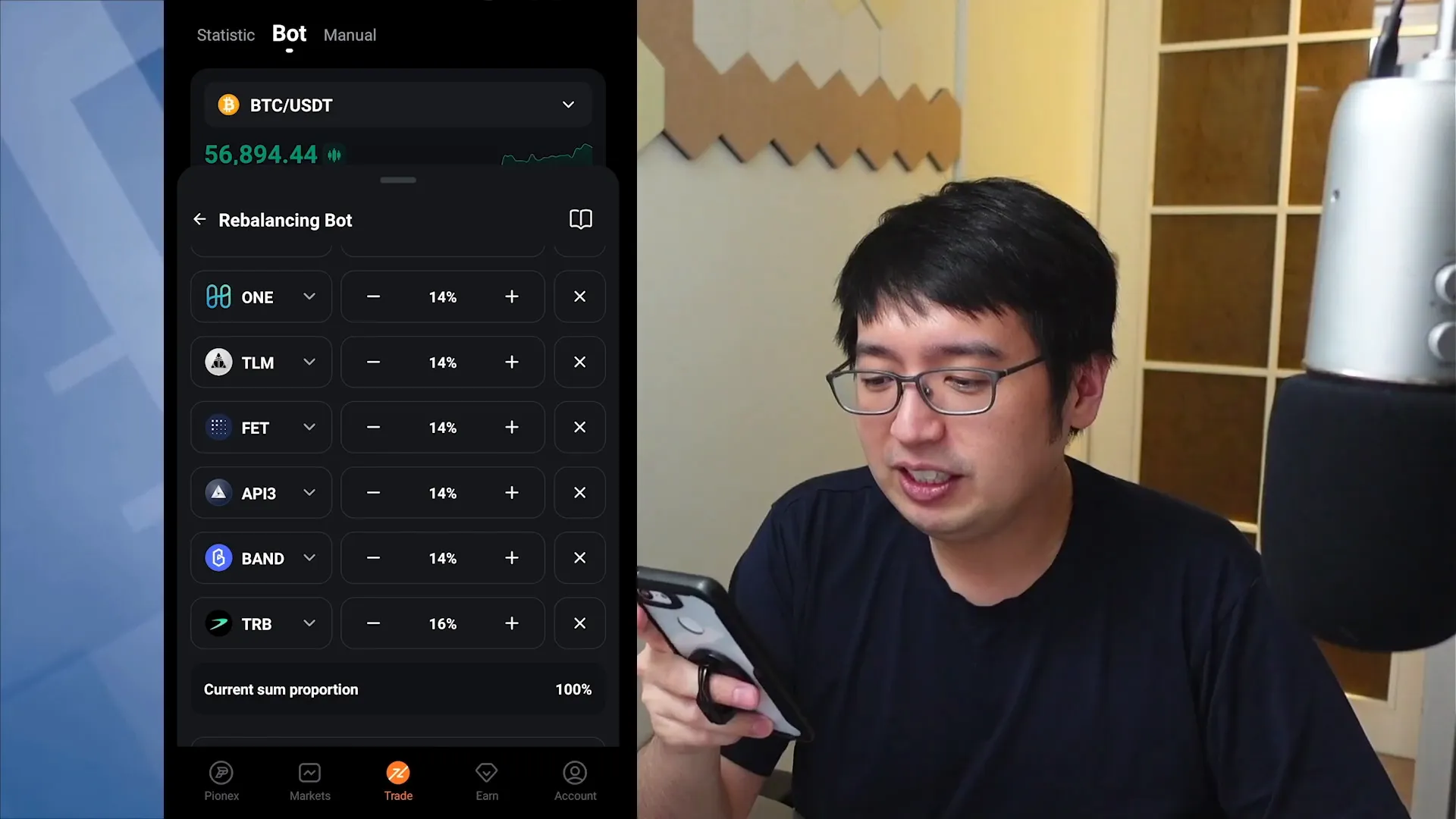

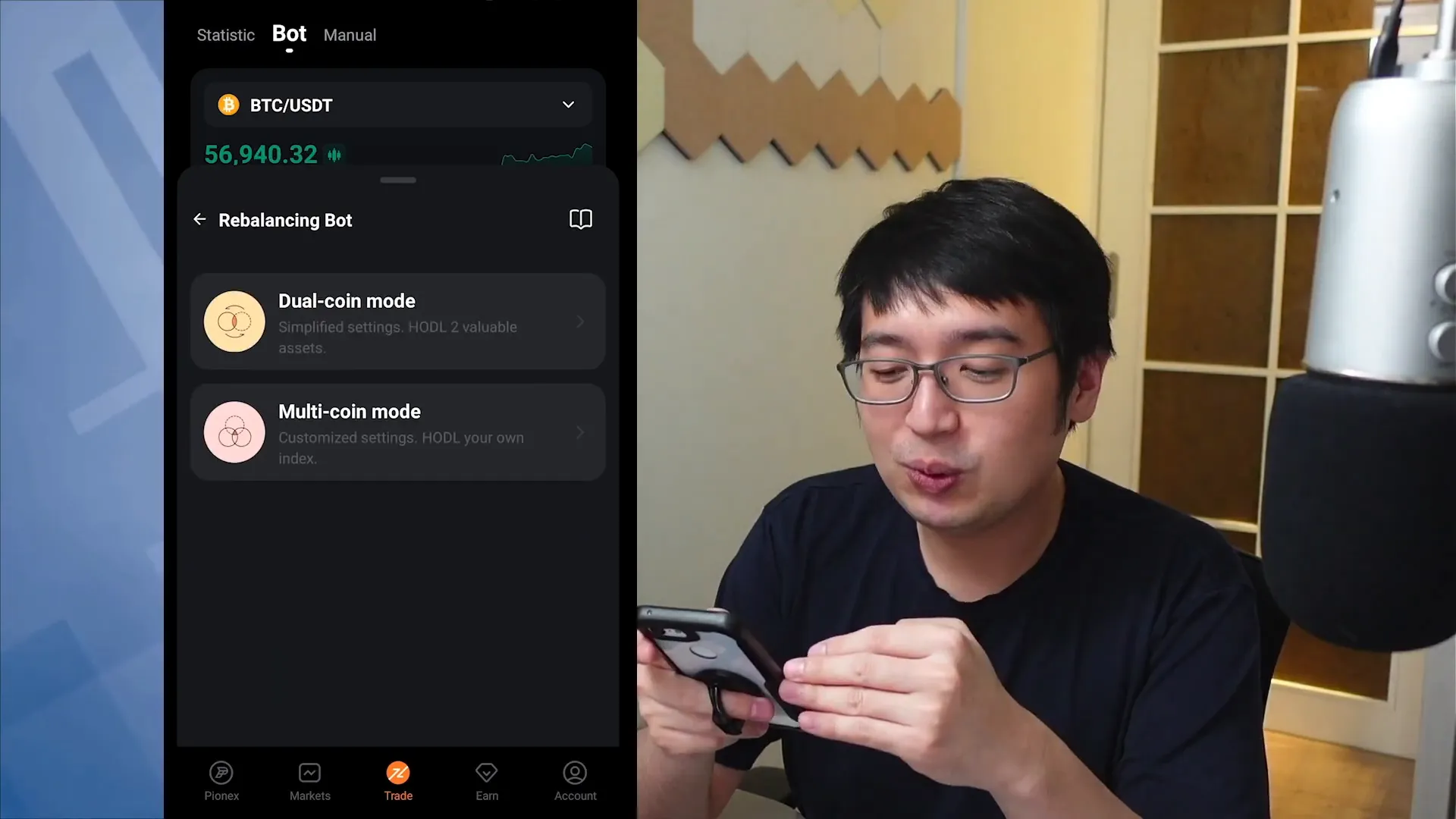

Creating a crypto ETF (Exchange-Traded Fund) using the Pionex platform is a seamless process. Start by selecting the type of rebalancing bot you wish to use, whether it’s a multi-coin or dual-coin setup. This choice will dictate how your assets are managed within the ETF.

Once you’ve made your selection, you can customize your ETF by adding various cryptocurrencies. Pionex allows you to allocate different amounts to each coin, enabling you to tailor your investment strategy based on your market outlook.

Choosing the Right Coins for Your ETF

Selecting the right cryptocurrencies for your ETF is essential for achieving your desired investment outcomes. Consider factors such as market capitalization, volatility, and growth potential when making your selections.

For a balanced approach, diversify your ETF by including a mix of established coins and promising altcoins. This strategy can help mitigate risk while providing opportunities for substantial returns.

Profit Potential with Pionex Bots

The profit potential with the pionex trading bots is significant, especially when using strategies like rebalancing and grid trading. By automating trades, users can capitalize on market movements without needing to monitor their investments constantly.

Many users have reported impressive gains using Pionex bots. However, it’s crucial to remember that while the potential for profit is high, so is the risk associated with cryptocurrency trading. Always conduct thorough research and consider your risk tolerance before investing.

Understanding Data Oracles

Data oracles play a pivotal role in the blockchain ecosystem. They act as bridges between the real world and blockchain smart contracts, providing external data that blockchain applications require to function accurately. For instance, when a smart contract needs to verify the price of an asset, it relies on data oracles to fetch this information from the real world.

One of the most recognized data oracles is Chainlink, which leads the market with a valuation of approximately $11 billion. This prominence highlights the increasing importance of data oracles as blockchain technology continues to evolve and integrate into various sectors like finance, supply chain, and more.

How Data Oracles Work

At their core, data oracles function by gathering data from multiple sources, verifying its accuracy, and then delivering it to the blockchain. This process ensures that smart contracts execute based on reliable and real-time information. Without data oracles, the functionality of many decentralized applications would be severely limited, as they would lack access to crucial external data.

There are different types of oracles, including:

- Software Oracles: These fetch data from online sources, such as APIs or web services.

- Hardware Oracles: These connect physical devices to the blockchain, providing data from the real world.

- Consensus Oracles: They gather data from multiple sources and use consensus mechanisms to determine the most accurate information.

Rebalancing Strategies Explained

Rebalancing is a key strategy in portfolio management, particularly in the context of a crypto ETF. It involves adjusting the proportions of different assets in your portfolio to maintain a desired risk level or to capitalize on market movements. The pionex trading bot automates this process, allowing users to focus on other aspects of trading.

There are two primary types of rebalancing strategies:

- Time-Based Rebalancing: This approach involves rebalancing at predetermined intervals (e.g., weekly, monthly). It helps maintain the desired asset allocation over time.

- Threshold-Based Rebalancing: This method triggers rebalancing when an asset’s percentage deviates from its target allocation beyond a set threshold. For instance, if a cryptocurrency rises significantly in value, it may exceed its target allocation and trigger a rebalance.

Benefits of Rebalancing

Implementing a rebalancing strategy can offer several benefits:

- Risk Management: By maintaining a balanced portfolio, you can manage risk more effectively, protecting your investments from significant market fluctuations.

- Profit Maximization: Rebalancing allows you to take profits from over-performing assets and reinvest them into under-performing ones, potentially enhancing overall returns.

- Emotional Detachment: Automated rebalancing through the pionex bot removes emotional decision-making from trading, leading to more disciplined investment strategies.

Managing Your Investments with Pionex

Using the pionex crypto trading bot for managing your investments simplifies the trading process. Pionex provides various bots tailored for different investment strategies, including grid trading, arbitrage, and rebalancing. These bots allow you to automate trades, ensuring you never miss opportunities in the volatile crypto market.

To manage your investments effectively, consider the following steps:

- Define Your Goals: Determine your investment objectives, whether it’s long-term growth, short-term gains, or a balanced approach.

- Select the Right Bots: Choose bots that align with your investment strategy. For example, the pionex grid bot is excellent for fluctuating markets, while the rebalancing bot suits long-term investors.

- Monitor Performance: Regularly review your portfolio’s performance and make necessary adjustments to your bots’ settings.

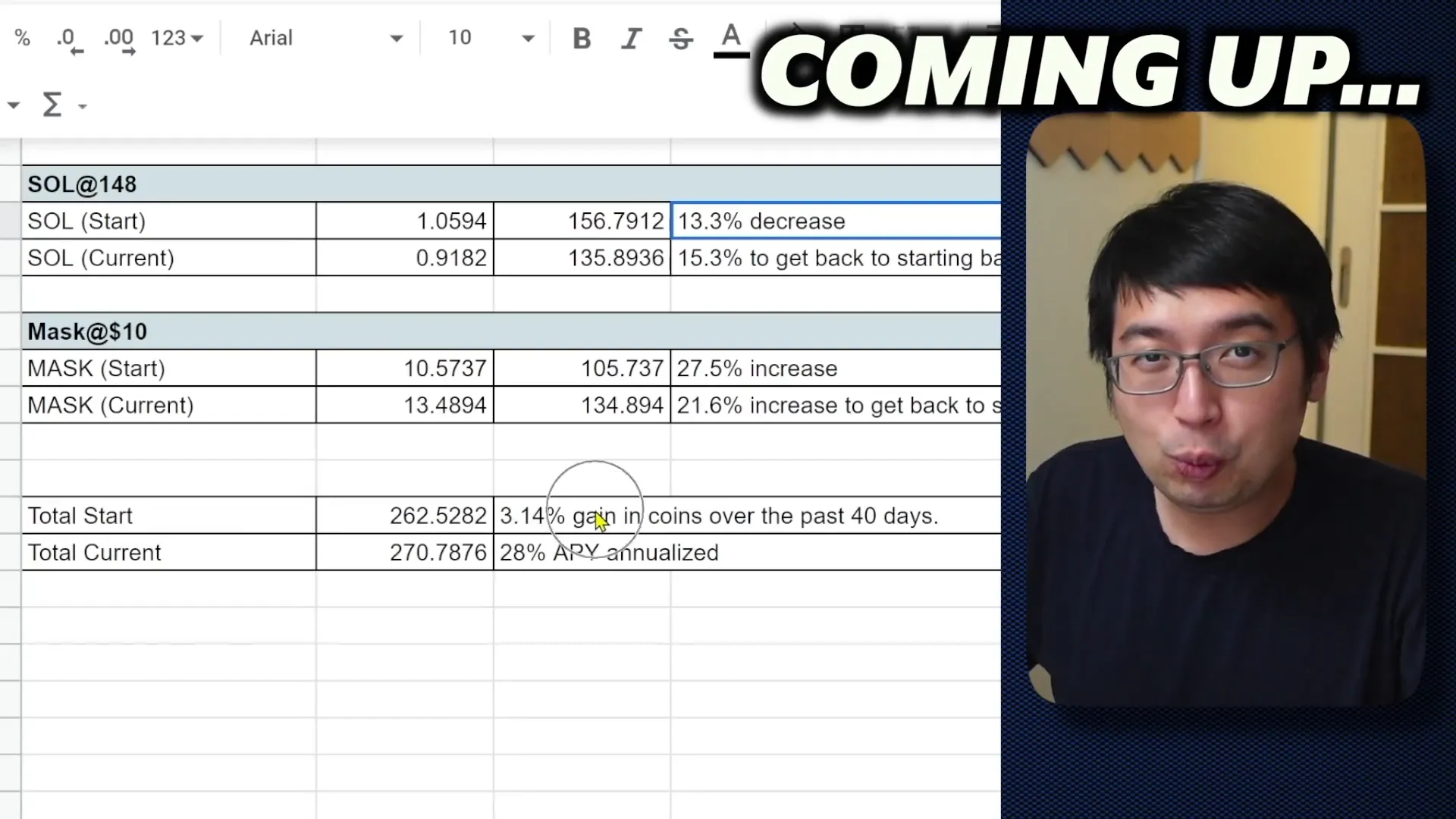

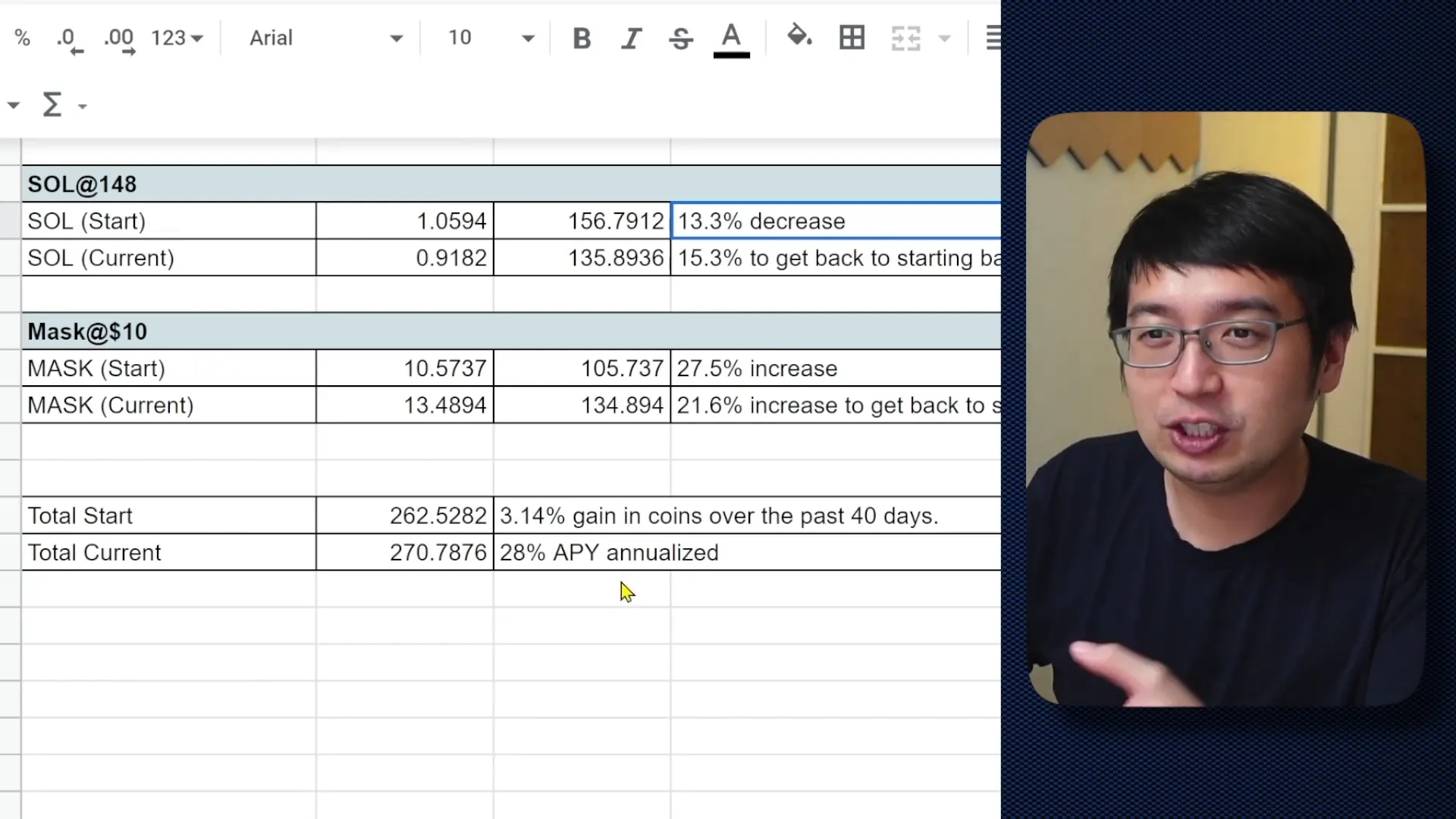

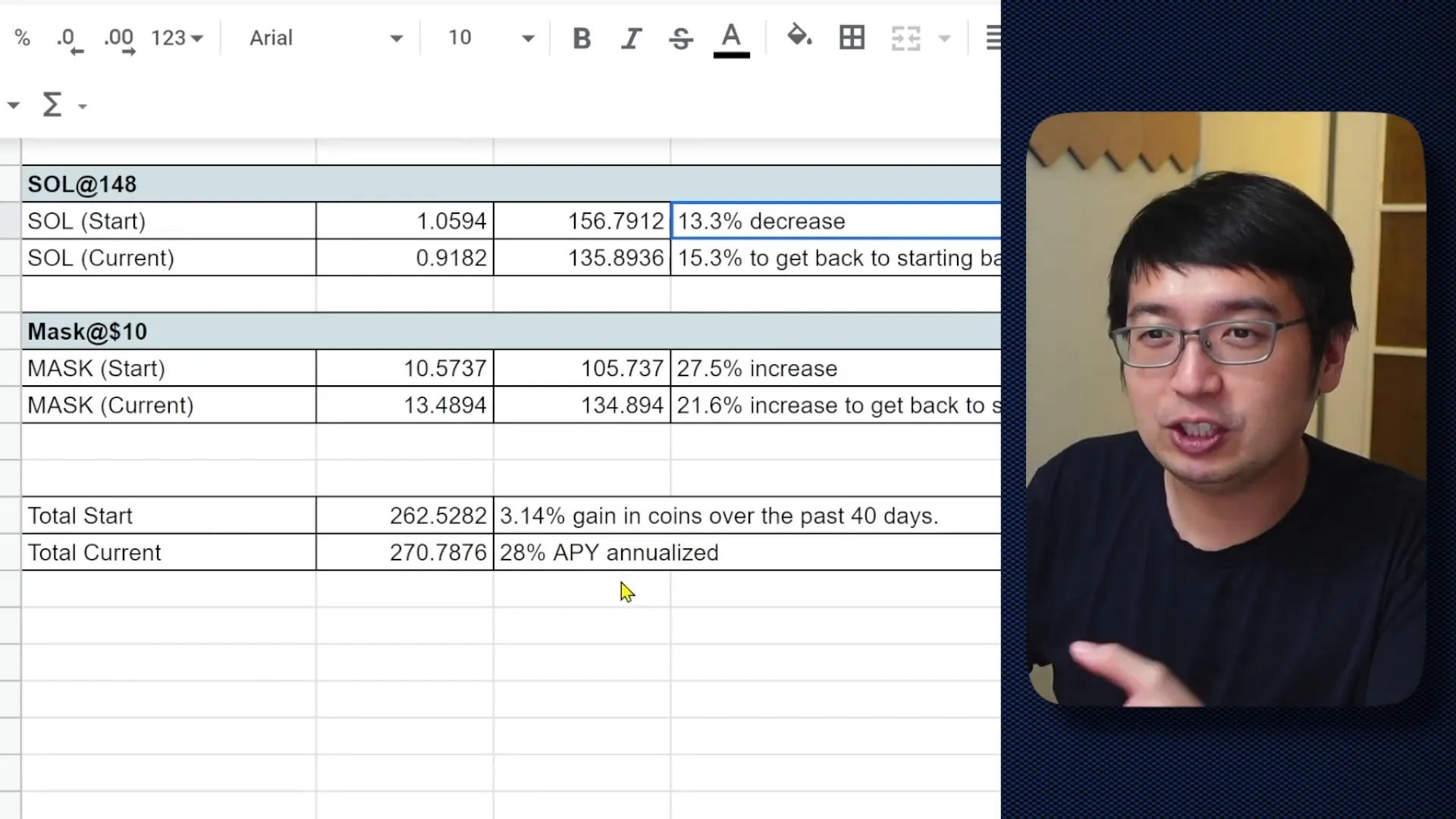

Calculating Returns on Your ETF

Calculating the returns on your crypto ETF is essential for assessing its performance and making informed investment decisions. The returns can be evaluated based on both capital gains and reinvested earnings. Here’s how to calculate your returns:

Steps to Calculate Returns

- Initial Investment: Start with the total amount invested in the ETF.

- Current Value: Determine the current market value of your ETF by evaluating the price of each cryptocurrency in your portfolio.

- Calculate Gains: Subtract the initial investment from the current value to find your total gains.

- Annualize Returns: To get a clearer picture of your investment performance, annualize your returns based on the time frame of your investment.

For example, if you invested $7,000 in a crypto ETF and its current value is $8,000, your total gain is $1,000. To annualize this return, you can calculate the percentage increase over the investment period and project that over a year.

Conclusion and Final Thoughts

Utilizing the pionex trading bot for creating and managing a crypto ETF can streamline your investment process. By leveraging automated strategies such as rebalancing, you can optimize your portfolio’s performance while minimizing the emotional aspects of trading. As you explore the world of cryptocurrency investments, remember to stay informed and adjust your strategies as needed.

Whether you’re a seasoned trader or a newcomer, the tools and strategies available through Pionex can enhance your trading experience. Always keep in mind the importance of understanding the assets you’re investing in and remain aware of the inherent risks involved in crypto trading.

FAQ

What is a Pionex Trading Bot?

A Pionex trading bot is an automated tool designed to execute trades based on predefined strategies. It helps users maximize their trading efficiency and capitalize on market movements without constant monitoring.

How do I set up a Pionex Bot?

Setting up a Pionex bot involves selecting the desired trading strategy, configuring the settings according to your investment goals, and activating the bot to start trading on your behalf.

Are there risks associated with using trading bots?

Yes, while trading bots can enhance your trading experience, they also come with risks. Market volatility can lead to potential losses, and it’s essential to understand the strategies employed by the bot.

For more insights and to start your journey with the pionex crypto trading bot, consider visiting our affiliate page for exclusive offers and resources. Also check out our other blogs written about pionex trading Bots here